I got blind-sided by my tax bill my first year out of the Navy. I wasn’t nearly as knowledgeable about taxes then as I am now, but I stayed on top of things. At least, I thought I did. Then that $6K tax bill caught me in the jaw and I had the opportunity to learn a little more about humility.

I don’t beat myself up about it too much. The year I transitioned out of military service to civilian life was stressful. I was suddenly confronted with all those choices I’d never had to make before. Were we going to stay in Virginia Beach? If we did, should we stay in the same house? Where should I work? What do I wear? Tricare Standard or Tricare Prime? That’s also the year my mother in-law went into hospice with stage 4 cancer. When life is coming at you that hard, it’s understandable that you’re not thinking much about your income tax withholding.

Another reason not to be too unhappy about that big tax bill was it helped propel me into my current career. A shock like that sent me back into the books to acquire more knowledge. One thing led to another and before I knew it, I was sitting for the Enrolled Agent exams.

Being a tax specialist for military families provides me the opportunity to observe trends in their tax returns. One of the things I’ve noticed is that many (maybe even most) military families who make it to the pension experience a spike in their tax bill the first year out of the service. When you analyze the situation with 20/20 hindsight, it is easy to see how it happens. But that is a busy year, and life is coming at you so hard you might not see it coming.

Here is what happens. Most military families – despite some anxiety about their future financial picture – see a significant increase in household income the first year out of uniform. Many people exit the service for equal or higher salaries in their civilian careers. Add a pension on top of that. Then consider that military spouses will often increase their earnings around that time. Without an imminent move, many military spouses become more career focused. When you add all that together it isn’t uncommon to see military families experience a 150% to 200% increase to their household income in their first post-military year. And all those new dollars are taxable.

The way our tax withholding system works is generally poor, but it is particularly inefficient for people in situations like a recent military retiree. A situation where you have multiple small-to-medium income streams that add up to a medium-to-large amount of income. Let me give you a brief illustration with simple numbers to show what I mean. Imagine a family where the military member retires and receives a $50,000 pension. He also begins earning $50,000 at his new job. His spouse is earning $50,000 at her job. In total they are earning $150,000.

They don’t have any kids and they use the standard deduction ($24,400 in 2019). That means a taxable income of $125,600 ($150,000 – $24,400). That’s in the 22% bracket. They should have tax withholding from their pay equal to the tax they will owe on $125,600. That’s unlikely to happen, though, unless they take some additional corrective action to fix their withholding. Otherwise, the way the tax withholding system works, they are in for a shock. Here’s why:

Neither DFAS (paying the pension), nor his employer, nor her employer knows about any income being paid other than the one they pay. So DFAS is withholding taxes based on taxable income of $25,600 ($50,000 – $24,400). His employer and her employer are doing the same thing. Each is withholding based on $25,600. Totaled together they are only withholding as if there will be taxable income of $76,800. ($25,600 + $25,600 + $25,600) Not only that, but because they are each withholding taxes as if the total tax bill will be based on $25,600 of taxable income, they are calculating the withholding based on a maximum tax rate of 12%. Not only is each employer withholding on too small an amount, they are also withholding at too low a rate! This couple is cruising for a BIG tax bill the next time they file their tax return.

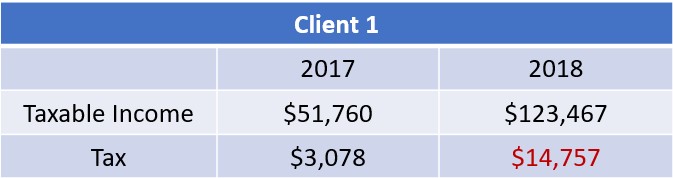

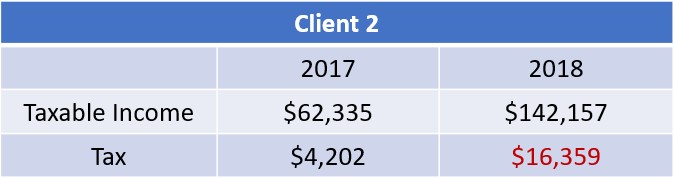

Now that we’ve walked through the simplistic scenario, let’s look at a couple of my actual clients from 2018. These are real numbers taken off real returns from two taxpayers who retired from the military in 2017 and experienced their first full year of civilian life in 2018.

Client 1 Withholding for 2018: $10,222

Client 2 Withholding for 2018: $12,262

Both these veterans saw nice increases to their household incomes their first year in retirement, but they saw even larger increases (as a percentage) in their income tax bills. And they both owed the IRS more than $4,000 by April 15. Keep in mind these are just the federal (IRS) tax bills. If you’re here in the Commonwealth of Virginia you probably went from zero to several thousand in taxes owed at the state level. It can be a real shocker if you aren’t prepared for it.

So, how do you prepare for it?

The short answer to that question is to do a tax withholding checkup to ensure you are having enough withheld from your military pension and employee pay to cover your federal and state income tax bills. Unfortunately, that can be complicated and confusing. Your analysis might show you need to have another $4,000 withheld to cover your tax bill. What does the IRS offer you? M0, M1, S1, S2, etc. In short, they offer you a withholding ‘code’ that doesn’t meaningfully correlate to an amount of withholding. You’re often stuck with I guess I’ll set it to M0 and see what happens…

The IRS is changing the withholding regimen starting January 1, 2020. The W4 form has changed significantly, and there will no longer be the dreaded S0, M1-type codes. There’s even some new FAQs to help you understand it. They tell me it’s going to be easier, but they increased the W4 from 2 pages to 4, so I’m a bit skeptical, Time will tell.

Another option is to have a tax professional review your tax withholding to ensure you don’t get an ugly surprise on your first tax return as a civilian. I happen to know one who conducts dozens of income tax withholding reviews for his clients every year. He knows his way around an LES and an RAS pretty well, too. If that interests you, give us a call at (757) 752-8055 and schedule a free consultation. We’d love to hear from you!